The Most Comprehensive Carbon Certification Standards Mapping on the Market: 2024-25

Approximately 10 years ago, World Bank analysts predicted that by 2025 or 2030 regional carbon markets would merge into a large single and global market. This prediction was formulated in the context of compliance carbon markets forming up at the time in Europe, North America, Australia and elsewhere. While this has not materialised, and the compliance carbon markets are still operating at national or regional levels, the voluntary carbon market (VCM) is not growing any simpler. Although the VCM is more global, in its impact and dynamics, the increasing number of carbon certification schemes, has made it more complex.

As explained in our carbon finance handbook, the role of most carbon certification standards is to perform three fundamental functions:

Develop, approve, and update rules, principles, and requirements defining the conditions under which carbon credits can be delivered.

Review carbon offset projects against these rules, principles and requirements.

Operate a registry system that issues, transfers, and retires carbon credits.

While the VCM had been operating with approximately 6 certification schemes for nearly 15 years (from 1996 to 2010), the recent years have seen the rise of numerous competing standards.

Considering that 15 new carbon certification schemes have seen the light of day in 2023, as many as the three previous years combined, it is anticipated that the number of standards will keep growing, before eventually consolidating, as was the case with the merger of Gold Standard and CarbonFix, and to so some extent the VCS and Climate Community and Biodiversity Standard.

Below you will find a range of infographics breaking down the complexity of certification standard schemes in different ways.

Our 2025 Carbon Certification Standard Infographics:

[Feel free to download and share]

65 Carbon Certification Standards? What is going on in the carbon market?!

Over a decade ago, World Bank analysts could not have been further from the truth when they predicted that by 2025-2030 regional carbon markets would merge into a single global market…

As we highlighted with our infographics last year, the fragmentation of certification schemes shows an increasingly complex picture! After reaching out to all of the certification schemes we could find, we have updated our database to feature the 65 Certification Schemes that we know are active in the world.

The high number of standards and rapid evolution of the space can be explained by several factors:

The need for specialised schemes within sectors: offering fewer and more focused tools, methodologies, with a range of simplifications

The need for culturally adapted schemes: not everyone works in English! Domestic or regional schemes can be rendered more accessible when available in the locally spoken languages (e.g., French, Spanish, Japanese, etc.)

The need for contextually adapted schemes: domestic or geographically specialised schemes can provide a range of default and locally relevant values that simplify the certification and verification processes

The need for more sovereignty: countries believe they should have control over how carbon credits are issued for domestic projects and carbon accounted for, as well as who these credits are issued to. Countries, often want to set aside some of the best practices in exchange for cost effectiveness.

The need for less resource-intensive processes: as the leading schemes grow in complexity to accommodate their stakeholder needs for integrity, this creates rooms for less sophisticated and/or more innovative schemes

We expect the number of schemes to keep growing over the years, followed by a consolidation of the competition with the weakest throwing in the towel. This process has already begun…

Carbon Certification Standards: a global perspective on emerging domestic trends

As the carbon market matures, carbon certification standards—frameworks ensuring that carbon credits represent real, measurable, and verifiable climate benefits—are increasingly at the forefront of discussions. While global standards like Verra's VCS and Gold Standard dominate the space, national and domestic standards are gaining traction.

But what exactly are these standards?

Here’s a rough definition: national or domestic carbon certification standards are country-specific frameworks designed to guide the development, registration, and issuance of carbon credits. These schemes often reflect national priorities, regulatory contexts, and alignment with international climate agreements. They are often run by government authorities, sometimes by affiliated organisations and are available in the local language.

From the west to the east: domestic schemes are emerging as targeted competitors to global standards. Initially taking place in Western countries, it is now taking place across Asia where J-Credits and Thai-VER are pioneers, and where Korea, Mongolia, Indonesia, and Malaysia have recently (or will soon) launch their own schemes.

Why this trend is emerging: governments are seeking greater control over carbon market revenues and ensuring alignment with Nationally Determined Contributions (NDCs). They aim to reduce reliance on international schemes and have schemes that are simpler and more cost-effective for project certification. Plus, Tailored standards allow for region-specific considerations, such as language, target sectors, and the use of tailored carbon accounting estimation

Potential evolution: the next decade could see a proliferation of domestic schemes, with more countries designing standards that align with Article 6 of the Paris Agreement and that could be used for 6.2 transactions, like in Premium T-VER in Thailand and JCM in Japan

Greater regional cooperation may lead to harmonized standards across economic blocs, facilitating cross-border carbon trading while maintaining high integrity, such as the efforts spearheaded by Singapore, Malaysia, Thailand and Indonesia

Over 5.3 BILLION carbon credits issued by 50 standards… but just TWO dominate the market. Why?

Let’s dive into some fascinating trends from the last 29 years of carbon credit certification:

The Top 2 standards rule the market:

The UN Climate Change's Clean Development Mechanism (CDM, 1997) and Verra’s VCS (2007) alone account for 70% of all issued credits. CDM leads with 45%, while VCS holds a 24% share. Combined, they’ve issued more credits than all other standards put together.

Gold Standard vs. VCS: a tale of two strategies

Though both launched around the same time, VCS has surged ahead. Why? A strategy focusing on REDD+ projects, large-scale renewables, and less conservative cookstove methodologies. Meanwhile, Gold Standard opted for a more conservative approach and refused to credit REDD+.

Geographic and sectoral specialization:

Standards like the ACR at Winrock International (American Carbon Registry), Climate Action Reserve, Australia’s ERF, and China’s CCER have focused on specific regions or sectors, issuing over 100M credits each.

The rise of REDD+ and the new players:

With a focus on REDD+ projects, standards like Architecture for REDD+ Transactions (ART), BioCarbon Standard, World Bank’s FCPF, COLCX & T-VER are growing rapidly. Emerging international and cross-sectoral standards like Cercarbono and Global Carbon Council have raised their profile significantly and are getting ready to take over the VCS and the GS.

What’s next?

A surprising number of standards (14!) have yet to issue their first credits, while others are still carving out their niche. Meanwhile, new domestic standards continue to emerge every year (check out our next infographics).

The rise of the new-wave standards

A new generation of standards is gaining traction and is scaling up rapidly (e.g., Isometric, Tero Carbon, Puro.earth, Isometric, ERS - Ecosystem Restoration Standard, Riverse, etc.)

Certification standard application scopes

In the constantly evolving world of carbon certification standards it can be difficult to understand the varying scopes… So we decided to break them down for you:

Here are 66 active carbon certification standards with insight into the realms in which they operate…

We highlighted the following categories:

Land Use, Land Use Change, and Forestry (ARR incl. agroforestry, agriculture, land restoration)

Conservation & REDD+ (incl. project & jurisdictional)

Carbon Dioxide Removal (incl. engineered carbon removal, biochar)

Industrial GHG emission reduction and energy efficiency

Methane Capture (incl. waste handling and disposal)

Renewable Energy

Domestic Energy Efficiency (incl. cookstoves, efficient lighting, water access, building energy efficiency)

As you can see on the last page, “Land Use, Land Use Change and Forestry” is the dominant scope, with 25% of the overall coverage by these 66 standards. The rest of the scopes range between 10-15% of the overall coverage.

As of January 2025, here are the CORSIA-approved carbon certification standards…

Why do these standards matter? CORSIA is expected to become one the major sources of demand for carbon credits, and only a handful of eligible standards have met the (demanding) criteria… And the approval process is stringent.

Let’s back up a little bit: CORSIA = the Carbon Offsetting and Reduction Scheme for International Aviation.

CORSIA was established in 2016 by the UN’s International Civil Aviation Organization (ICAO) as a market-based mechanism to support carbon-neutral growth in the aviation industry. While participation is voluntary until 2027, flights between countries that have committed to align with CORSIA are required to comply… Meaning the airline operators that emit over 10,000 tonnes of CO2 per year must monitor, report, and purchase credits to offset some of their emissions. At this point, 126 countries have committed to the First Phase.

A month ago, the ICAO released a series of documents detailing revised eligibility and exclusion criteria for crediting programs as part of Phase 1 for CORSIA. The updated guidelines exclude project types like large-scale REDD+ credits (>7,000 per year), afforestation/reforestation, and renewable energy projects above 15 MW.

This will undoubtedly have a major impact on the VCM. As demand and competition increases for the subset of eligible projects, prices will sky-rocket, due to the limited eligible supply and the overlapping eligibility with other market segments. We are expecting this to send strong positive market signals in 2025.

The goal of all of this? Aligning with the Paris Agreement, pushing for higher integrity credits, and emphasizing integrity and transparency.

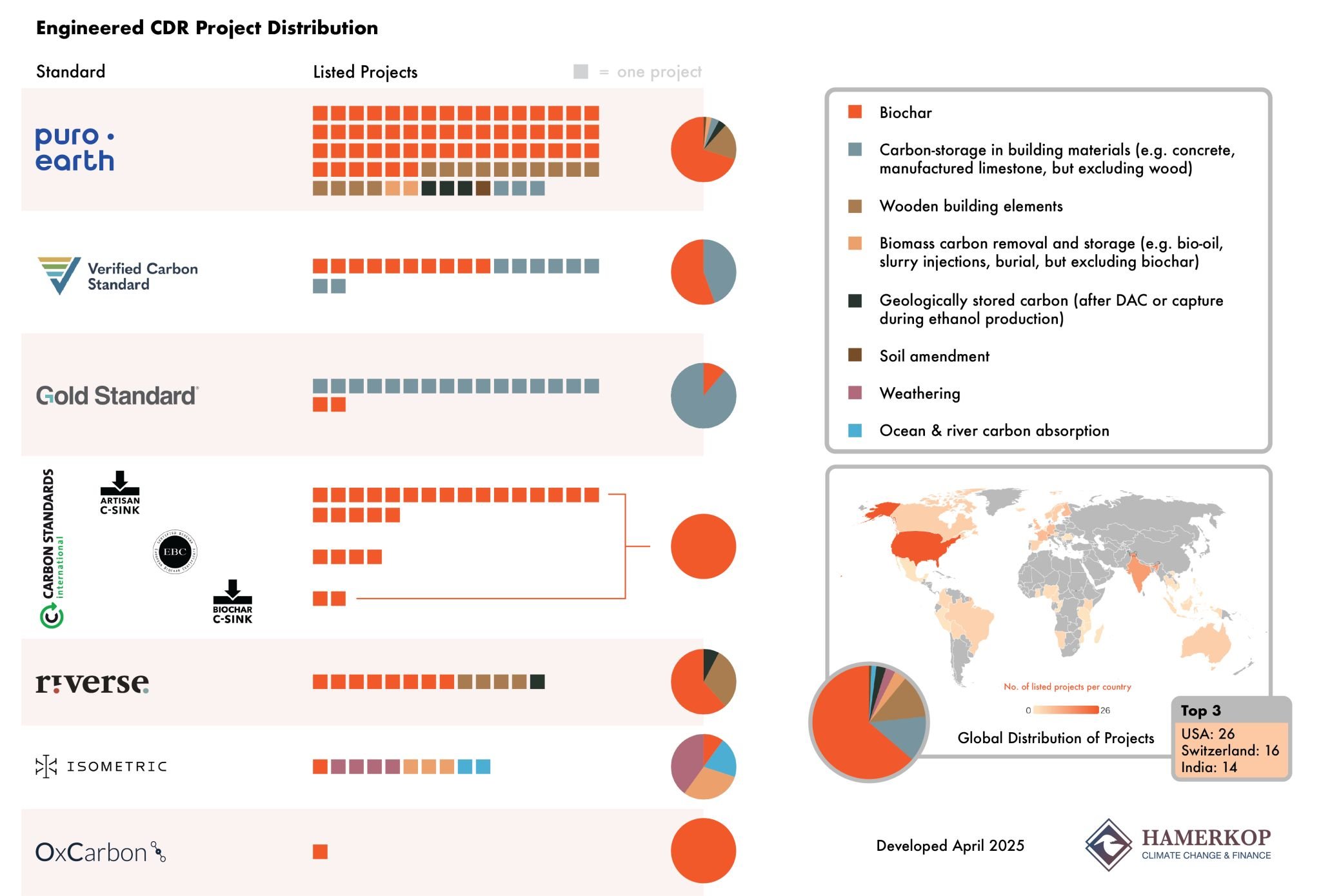

The state of (listed) engineered carbon dioxide removal projects

Carbon Dioxide Removal (CDR) is the process of capturing and storing carbon dioxide through natural interventions and/or technological processes. There are many ways to do this, and the methodologies are constantly evolving… Some of the most common types of engineered carbon removal listed on the registries included are:

the production of biochar,

carbon sequestration and long-term storage in building materials (like carbonated concrete aggregate),

biomass carbon removal and storage (e.g. bio-oil and slurry injections)

In our infographic, we broke down the categories of CDR based on the commonalities in project type across various standards and methodologies. As you can see, biochar dominates the sector. Nevertheless, more technological sequestration and storage methodologies are being developed across all registries.

Our takeaways:

CDR (including nature based and engineered) and avoidance of emissions both need to be done in tandem to limit emissions

Although nature based is generally cheaper, engineered has its own advantages such as being more readily available in the short term, being more durable, having greater scalability and featuring more location flexibility

Engineered CDR is constrained by costs, energy needs and potential land and climate impacts – relying too hard on engineered CDR could limit growth of other mitigation efforts

Biochar is the driver of the engineered carbon removals market, but other technologies are developing quickly (like DAC, ocean alkalinity, bioenergy with CCS and BECCS, enhanced weathering, ocean fertilisation)

Southeast Asia Focus

Southeast Asian Certification Standard Recognition and Usage

Southeast Asian countries are increasingly utilising Nature-based Solutions for climate mitigation

We analysed NbS including 𝗔𝗥𝗥, 𝗥𝗘𝗗𝗗+, 𝗜𝗙𝗠 and 𝗪𝗲𝘁𝗹𝗮𝗻𝗱 𝗥𝗲𝘀𝘁𝗼𝗿𝗮𝘁𝗶𝗼𝗻 across five Southeast Asian countries: Indonesia, Malaysia, Thailand, Cambodia, and The Philippines… And dove into 𝟭𝟯 𝗰𝗲𝗿𝘁𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻 𝘀𝘁𝗮𝗻𝗱𝗮𝗿𝗱𝘀 to observe whether these countries have recognised and/or used these standards in building their NbS projects.

This helps us understand the current landscape of NbS and the larger national policies and strategies at play in the context of Southeast Asia…

Countries are increasingly shifting their national carbon markets and climate policies to utilise NbS and align with recognized certification standards.

Reforestation and Mangrove Restoration in SE Asia

Swipe through to see our two infographics documenting project costs, carbon sequestration costs, carbon margin profit, and potential for both 𝗥𝗲𝗳𝗼𝗿𝗲𝘀𝘁𝗮𝘁𝗶𝗼𝗻 and 𝗠𝗮𝗻𝗴𝗿𝗼𝘃𝗲 𝗥𝗲𝘀𝘁𝗼𝗿𝗮𝘁𝗶𝗼𝗻 projects in SE Asia

𝗞𝗲𝘆 𝗧𝗮𝗸𝗲𝗮𝘄𝗮𝘆𝘀:

𝗦𝘁𝗿𝗼𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁 𝗣𝗿𝗲𝘀𝗲𝗻𝗰𝗲: Indonesia and Cambodia supply ≈96% of NbS credits [mostly through REDD+ projects], while ARR and blue carbon remain underrepresented.

𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝘃𝗲 𝗖𝗼𝘀𝘁𝘀 & 𝗣𝗿𝗼𝗳𝗶𝘁𝘀: Reforestation credits cost ~USD 7–9/tCO₂ vs. mangroves at USD 10–12/tCO₂, with profit margins of USD 15–20/tCO₂.

𝗛𝗶𝗴𝗵 𝗣𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹: Indonesia leads with ~149 MtCO₂/year reforestation potential; blue carbon, though valuable, is geographically constrained.

𝗣𝗶𝗽𝗲𝗹𝗶𝗻𝗲 𝗠𝗼𝗺𝗲𝗻𝘁𝘂𝗺: 28 projects are in development under Verra/Gold Standard, while Thailand’s T-VER program is expected to generate >1.2 MtCO₂/year domestically.

𝗕𝗿𝗼𝗮𝗱𝗲𝗿 𝗜𝗺𝗽𝗮𝗰𝘁: NbS projects deliver biodiversity, coastal protection, and water-quality co-benefits.

The Suitability Landscape and Recommendations for Carbon Standards in the Nature-based Solutions Sector

We analysed the national priorities, planning documents, platforms for carbon trading, and more to figure out the state of 𝗰𝗮𝗿𝗯𝗼𝗻 𝘀𝘁𝗮𝗻𝗱𝗮𝗿𝗱𝘀 for 𝗡𝗮𝘁𝘂𝗿𝗲-𝗯𝗮𝘀𝗲𝗱 𝗦𝗼𝗹𝘂𝘁𝗶𝗼𝗻𝘀 in Southeast Asia

[There’s a lot here, we know… Feel free to download the slides to keep as your personal cheat sheet]

This is a general overview of the 𝘀𝘂𝗶𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗹𝗮𝗻𝗱𝘀𝗰𝗮𝗽𝗲 and 𝗼𝘂𝗿 𝗿𝗲𝗰𝗼𝗺𝗺𝗲𝗻𝗱𝗮𝘁𝗶𝗼𝗻𝘀 for which standards to use in Indonesia, Thailand, The Philippines, Malaysia, and Cambodia based on specific insight from their national priorities, precedents, and systems in place

As you can see, Verra’s Verified Carbon Standard and the Gold Standard dominate the current project landscape…

That being said, new standards are quickly arriving on the scene, appealing to different niches and types of project. We’ll keep you updated as the space grows and more projects are registered with these different standards.

➡️ Swipe for a detailed overview and our recommendations for the most applicable standards to use in each country (and for each kind of NbS project). [Link to the Linkedin post here]

CONCLUSION

Through this analysis, we aim to shed some light on the complex world of carbon certification standards at a time where financial sponsors and buyers of carbon credits are looking for clarity and visibility over the quality of their investments and purchases.

HAMERKOP’s experts have more than a decade of experience working with the carbon market ecosystem, including reviewing and supporting the creation of new certification standards and methodologies and supporting project developers in selecting the right standard for them and designing their climate change mitigation intervention accordingly. If you are looking for support in this space, we can help, reach out to us.

This is a highly dynamic space and if you know of a scheme that would fit on these maps, do let us know as we will update this map regularly!